Forgery is a serious criminal offense under Ohio law, involving acts of falsification or fraud intended to deceive others. Governed by Ohio Revised Code (ORC) § 2913.31, forgery encompasses various forms of document alteration, counterfeiting, and fraudulent representation.

Cincinnati Lawyer for Forgery Charges

Not everyone that is charged with forgery is a secret mastermind. The truth is that letting a forged document slip by as you sign off on it, or accidentally misrepresenting yourself can result in forgery charges. However, law enforcement tends to err on the side of caution, meaning that if you’ve been charged with forgery, you can expect a long, difficult road ahead.

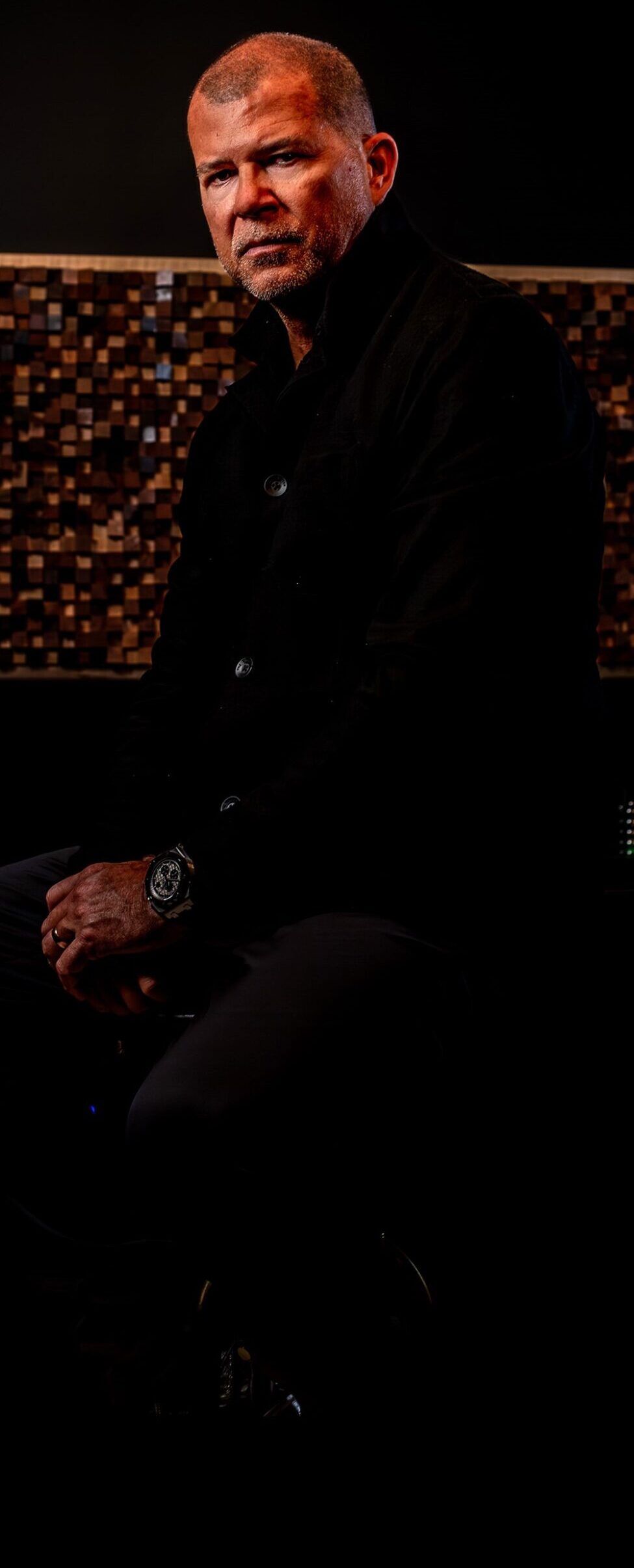

The Wieczorek Law Firm, LLC is a dedicated criminal defense firm with a history of success. Mark Wieczorek has been defending clients since 2008.

Mark Wieczorek serves all of Ohio, including Hamilton County, Butler County, Clermont County, Brown County, Highland County, Clinton County, Preble County, Scioto County, Greene County, Montgomery County, and Warren County, and Southern Ohio.

Call (513) 317-5987 for a free initial consultation, or fill out our online contact form.

- Overview of Forgery Charges in Ohio:

- Forgery under Ohio Law

- Key Definitions

- Penalties

- Defenses to Forgery

- Additional Resources

- Hire an Attorney for Forgery Charges in Hamilton County, OH

Forgery under Ohio Law

Forgery in Ohio is defined in ORC § 2913.31. The statute outlines multiple ways in which forgery can occur, specifying the intent to defraud or deceive as a central element of the crime. The key provisions are as follows:

ORC § 2913.31(A): “No person, with purpose to defraud, or knowing that the person is facilitating a fraud, shall do any of the following:

(1) Forge any writing of another without the other person’s authority;

(2) Forge any writing so that it purports to be genuine when it is actually spurious, or to be the act of another who did not authorize the act, or to have been executed at a time or place or with terms different from what in fact was the case, or to be a copy of an original when no such original existed;

(3) Utter, or possess with purpose to utter, any writing that the person knows to have been forged.”

These subsections capture the breadth of forgery, from creating false documents to knowingly using forged materials.

Key Definitions

The legal interpretation of forgery hinges on several definitions in Ohio law:

- Forge: Defined broadly as altering, making, completing, executing, authenticating, or transferring any writing to deceive or defraud.

- Writing: Includes any tangible or electronic record of communication, whether physical (e.g., checks, contracts) or digital (e.g., e-signatures).

- Purpose to Defraud: Under ORC § 2913.01(B), this includes the intention to secure an unlawful benefit or to harm another person.

- Utter: To use, present, or transfer a forged document with the intent to defraud or deceive.

All of these terms are elements of a forgery case that, with the exception of “writing,” the prosecution must prove.

Penalties

The penalties for forgery in Ohio depend on the circumstances and the value of the property or harm involved. Typically, forgery is classified as follows:

- Fifth-Degree Felony: The most common classification for forgery, punishable by:

- Prison Term: 6 to 12 months.

- Fines: Up to $2,500.

- Fourth-Degree Felony: If the forged document is a will, public record, or other legally significant document, the offense escalates, punishable by:

- Prison Term: 6 to 18 months.

- Fines: Up to $5,000.

- Third-Degree Felony: If the forgery involves significant financial harm or affects government operations, it may be punished by:

- Prison Term: 1 to 5 years.

- Fines: Up to $10,000.

Penalties may also include restitution to victims for financial losses incurred as a result of the forgery, as well as the possibility of a civil suit.

Defenses to Forgery

Generally, defenses to forgery in court fall into one or more of three primary categories:

- Intent – An attorney may argue that their client did not intend to commit forgery. Forgery does not always mean faking a signature – it can also mean completing actions on someone’s behalf that result in forgery, even if the defendant did not know or realize it to be such. Employees who unknowingly sign off on forged documents often take the fall when the documents are found to be fraudulent.

- Mistaken Identity – In many cases, the actual forger is another person. In cases of identity theft, the criminal may use a person’s credentials to write fraudulent checks, fill out forms, and take other illegal actions with the knowledge that their identity is safe, and the victim will be charged with forgery.

Additional Resources

- Ohio Revised Code Section 2913.31 – This section of the Ohio Revised Code defines forgery offenses, detailing prohibited actions, associated penalties, and legal definitions pertinent to forgery in the state.

- Forgery – Ohio Public Defender Commission – This resource from the Ohio Public Defender Commission offers an analysis of forgery laws, including case summaries and interpretations that are valuable for defense attorneys and individuals seeking a deeper understanding of legal precedents in Ohio.

Hire an Attorney for Forgery Charges in Hamilton County, OH

If you have been charged with forgery, know that law enforcement is convinced that you are responsible for defrauding one or many victims. Fighting forgery charges takes significant time, effort, and knowledge to be able to trace back through your steps to prove that you are not the person identified as the forger, or that you could not have known that your actions constituted forgery.

Mark Wieczorek is an attorney for forgery charges. Mark Wieczorek who serves clients in Southern Ohio, as well as the cities of Cincinnati, Columbus, Akron, Dayton, Toledo and South Point.

Call (513) 317-5987 for a free initial consultation, or fill out our online contact form.