Counterfeiting is a serious criminal offense under Ohio law, involving the creation, reproduction, or distribution of fraudulent items, most commonly currency, identification documents, or branded goods, with the intent to deceive. Counterfeiting in Ohio is governed primarily by Ohio Revised Code (ORC) § 2913.30, which outlines prohibited acts and the penalties associated with producing or possessing counterfeit items.

Cincinnati Lawyer for Counterfeiting Charges

Many people charged with counterfeiting are not sophisticated criminals running complex printing operations. In reality, even possessing an item you did not realize was counterfeit, or unknowingly passing along fraudulent currency or documents, can lead to criminal charges. Law enforcement typically assumes intentional wrongdoing, meaning anyone accused of counterfeiting is likely to face an extensive investigation and aggressive prosecution.

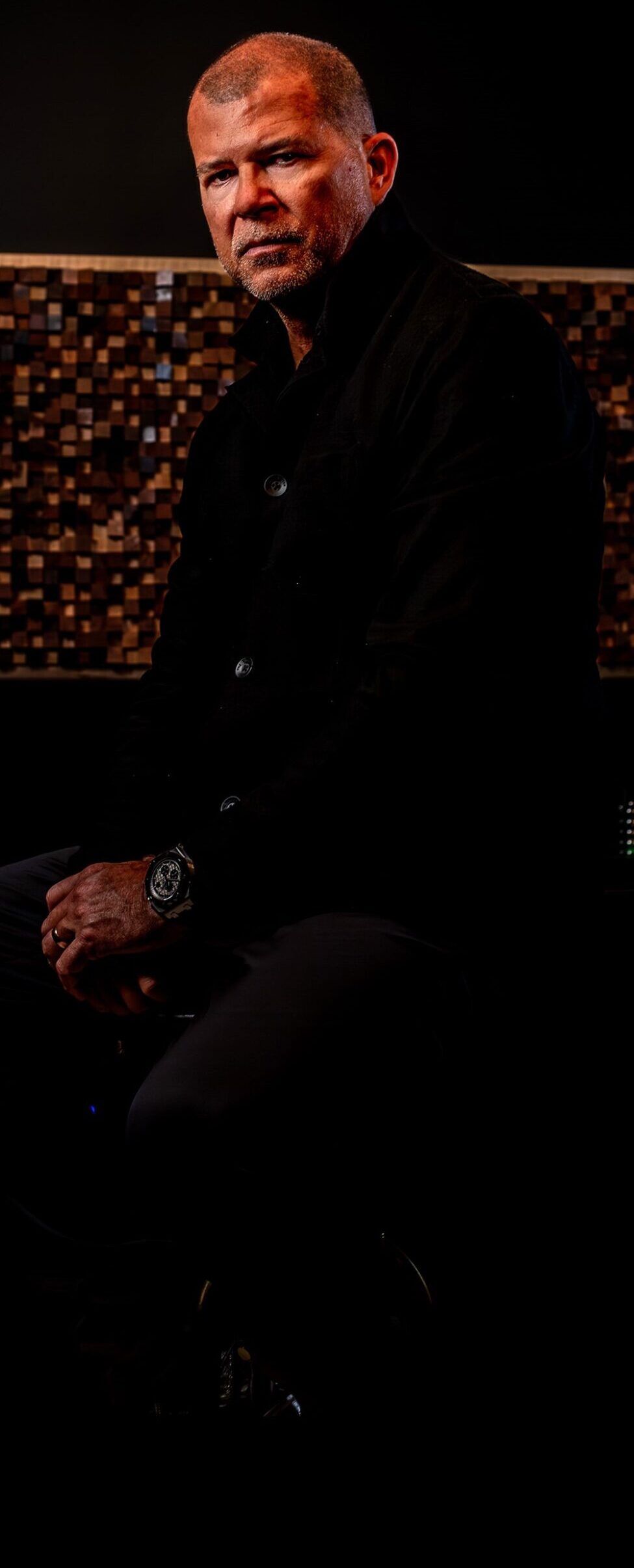

The Wieczorek Law Firm, LLC is a dedicated criminal defense practice with a proven record of success. Attorney Mark Wieczorek has defended clients throughout Ohio since 2008, bringing experience, strategy, and diligence to each case.

Mark Wieczorek serves all of Ohio, including Hamilton County, Butler County, Clermont County, Brown County, Highland County, Clinton County, Preble County, Scioto County, Greene County, Montgomery County, and Warren County, and throughout Southern Ohio.

Call (513) 317-5987 for a free consultation, or submit an online contact form.

- Overview of Counterfeiting Charges in Ohio:

- Counterfeiting Under Ohio Law

- Examples of Counterfeiting

- Key Definitions

- Impact of Ohio House Bill 366 on Counterfeiting and Electronic Search Warrants

- Penalties to Counterfeiting in Ohio

- Defenses to Counterfeiting

- Frequently Asked Questions

- Additional Resources

Counterfeiting Under Ohio Law

Counterfeiting statutes in Ohio are found in ORC § 2913.30, which criminalizes making, possessing, or using counterfeit items with fraudulent intent. The statute covers more than just fake currency. Counterfeiting can involve documents, labels, trademarks, payment instruments, and government-issued identification.

Key provisions of ORC § 2913.30 include:

ORC § 2913.30(A):

“No person, with purpose to defraud, shall do any of the following:”

- Manufacture, reproduce, or duplicate any counterfeit writing, mark, label, trademark, or identification.

- Possess any counterfeit writing, device, or instrument with the purpose to use it in committing fraud.

- Sell, transfer, or distribute counterfeit items, knowing them to be fraudulent.

- Use or attempt to use any counterfeit writing, trademark, label, or identification to deceive another.

These provisions encompass the full range of counterfeiting activity, from sophisticated production operations to the mere possession of fraudulent items intended for use.

Examples of Counterfeiting

Counterfeiting can occur in many forms, ranging from simple possession of fraudulent items to participating in complex manufacturing or distribution schemes. Common examples include:

Counterfeit Currency

- Creating or printing fake U.S. bills

- Passing counterfeit money at stores, restaurants, or banks

- Possessing bills that have been bleached, reprinted, or altered to appear of higher denomination

Counterfeit Identification

- Producing or selling fake driver’s licenses or state IDs

- Possessing fraudulent IDs used to buy alcohol, gain employment, or access restricted areas

- Altering genuine IDs to change names, ages, or other information

Counterfeit Documents and Certificates

- Fake car titles, deeds, or legal documents

- Fraudulent professional licenses or permits

- Altered certificates (birth certificates, death certificates, vaccination cards, etc.)

Counterfeit Goods and Trademarks

- Manufacturing or selling items with copied brand logos (handbags, watches, electronics, clothing)

- Distributing goods with fake safety labels, serial numbers, or warranty seals

- Selling “knockoff” products represented as authentic

Counterfeit Payment Instruments

- Fake checks, money orders, gift cards, or prepaid debit cards

- Altered account numbers or routing information

- Checks printed on fraudulent templates or using stolen identities

Digital Counterfeiting

- Creating fraudulent digital credentials, QR codes, or electronic tickets

- Producing counterfeit cryptocurrency tokens or digital payment assets

- Forging electronic signatures or encryption keys

Key Definitions

Understanding the terminology in Ohio’s counterfeiting laws is critical to evaluating the strength of a prosecution’s case. Important definitions include:

Counterfeit: Any writing, device, identification, label, or trademark falsely made, copied, or forged with intent to deceive.

Writing: Includes physical and electronic documents, certificates, labels, markings, currency, checks, identification cards, and digital records.

Trademark or Label: Covers manufacturer trademarks, certification labels, serial numbers, security features, and branded packaging—often used in counterfeit goods cases.

Purpose to Defraud: As defined in ORC § 2913.01(B), this involves intent to secure an unlawful benefit or to cause harm to another person.

Manufacture / Possession of Counterfeit Devices: Includes having printing equipment, digital templates, embossing devices, or other tools commonly used to create fraudulent items.

Impact of Ohio House Bill 366 on Counterfeiting and Electronic Search Warrants

Ohio’s House Bill 366 introduced significant updates to criminal statutes and investigative procedures, particularly affecting how counterfeiting offenses are charged and how electronic evidence is obtained. Because modern counterfeiting often involves digital tools and access-device manipulation, these changes materially impact both prosecutors and defense attorneys.

Expanded Counterfeiting Liability for Access Devices

One of the most consequential updates in House Bill 366 is the broadened definition of conduct that can qualify as counterfeiting. Under the revised law:

- Unauthorized scanning, encoding, or altering of access devices, such as gift cards, payment cards, electronic account numbers, or magnetic strips, can now fall under Ohio’s criminal counterfeiting statute.

- Conduct that was previously charged under narrower fraud or theft statutes may now be prosecuted as counterfeiting, exposing defendants to more serious penalties.

- The bill explicitly includes devices commonly used in skimming or card-fraud operations, such as magnetic stripe encoders, RFID skimmers, or cloning hardware, within the scope of “counterfeit devices.”

This expansion gives prosecutors a broader legal toolset, allowing them to treat digital or electronic payment-card fraud as counterfeiting rather than simply unauthorized use or identity theft.

Electronic Search Warrants and Digital Evidence

House Bill 366 also modernized the procedures surrounding electronic search warrants by:

- Allowing remote approval and streamlining judicial authorization, enabling officers to obtain warrants more quickly.

- Expanding the scope of permitted searches to include computers, smartphones, printers, storage media, cloud accounts, and encryption-protected data.

- Facilitating law enforcement’s ability to seize and analyze digital tools involved in access-device manipulation or counterfeit production.

Because many counterfeiting cases now involve digital templates, encoding software, or evidence stored electronically, these changes give investigators more immediate access to the devices central to their theory of the case.

Penalties to Counterfeiting in Ohio

Counterfeiting penalties in Ohio vary based on the type of counterfeit item, financial harm, and whether the offense involves government documents or trademarks. Common classifications include:

Fifth-Degree Felony (F5): Often charged when counterfeit items are of relatively low value or involve non-essential documents. Punishable by:

- 6 to 12 months in prison

- Up to $2,500 in fines

Fourth-Degree Felony (F4): Applies when the counterfeit item involves official documents, identification cards, certificates, or sensitive materials. Punishable by:

- 6 to 18 months in prison

- Up to $5,000 in fines

Third-Degree Felony (F3): Charged when the offense involves:

- Government-issued currency

- Significant financial harm

- Large-scale distribution of counterfeit goods

- Substantial interference with government operations

Punishable by:

- 1 to 5 years in prison

- Up to $10,000 in fines

Courts may also impose:

- Restitution for financial losses

- Forfeiture of equipment used in counterfeiting

- Civil liability from harmed businesses, trademark owners, or individuals

Counterfeiting cases often trigger federal involvement, especially when U.S. currency is implicated.

Defenses to Counterfeiting

While every case is unique, counterfeiting charges are often contested using one or more of the following defenses:

Lack of Intent: Counterfeiting requires intentional fraud. If the accused did not know an item was counterfeit, or believed they were acting lawfully, there may be no criminal liability.

Examples:

- Cashing a counterfeit bill unknowingly

- Possessing mislabeled items without awareness

- Holding printing equipment for a legitimate purpose

Mistaken Identity: Individuals may be incorrectly accused, especially in cases involving:

- Digital counterfeiting

- Identity theft

- Shared workspaces or equipment

- Use of another person’s account, printer, or credentials

Proving a defendant was not the person who created or used the counterfeit item can be a strong defense.

Insufficient Evidence: The prosecution must prove:

- The item was counterfeit

- The defendant knew it

- The defendant intended to defraud

- Cases frequently collapse when:

- Items cannot be tied to the defendant

- Equipment shows no evidence of fraudulent use

Frequently Asked Questions

What exactly counts as “counterfeiting” under Ohio law?

Counterfeiting includes creating, altering, possessing, or using fraudulent items, such as currency, identification, documents, trademarks, or access devices, with the intent to deceive or defraud. Under House Bill 366, counterfeiting also covers unauthorized scanning or encoding of payment cards, gift cards, or other access devices.

Can I be charged with counterfeiting even if I didn’t make the counterfeit item?

Yes. Ohio law allows prosecutors to charge individuals for possessing, using, or attempting to pass counterfeit items, even if they were not the original creator. The key question is whether the person knew the item was counterfeit and intended to defraud.

How does House Bill 366 affect counterfeiting cases involving access devices?

House Bill 366 expanded Ohio’s counterfeiting statute to include:

- Unauthorized scanning or encoding of access devices (gift cards, payment cards, digital accounts).

- Possession of devices used for skimming, cloning, or re-encoding cards.

This means conduct traditionally charged as theft, identity fraud, or misuse of credit cards can now result in counterfeiting charges, which often carry harsher penalties.

What types of electronic devices can police search in a counterfeiting investigation?

With the updated electronic search warrant provisions under HB 366, police may be able to search:

- Computers and laptops

- Smartphones and tablets

- Printers, card encoders, and design equipment

- USB drives, SD cards, and cloud-storage accounts

Investigators often target digital design files, transaction logs, or communications related to counterfeit production.

What penalties can I face if convicted of counterfeiting in Ohio?

Penalties depend on the type of counterfeit item and the financial harm involved. Most counterfeiting charges range from fifth-degree felonies (6–12 months in prison) to third-degree felonies (1–5 years in prison). Courts may also impose fines, restitution, forfeiture of equipment, and civil liability.

Can I be charged with a federal crime for counterfeiting?

Yes. Counterfeiting involving U.S. currency, government documents, or activity crossing state lines can trigger federal charges, often investigated by the U.S. Secret Service or FBI. Federal penalties can be significantly harsher than state penalties.

Is it a defense if I didn’t know the item was counterfeit?

Lack of knowledge is a potential defense. Counterfeiting requires intent to defraud, meaning a person who unknowingly possessed or passed a counterfeit item, such as receiving a fake bill in change, may not be criminally liable.

What should I do if police ask to search my electronic devices?

You have the right to:

- Decline consent to a search

- Request that police obtain a warrant

- Speak with an attorney before answering questions

Electronic devices often contain vast amounts of personal data, so legal guidance is crucial.

Additional Resources

Below are resources that provide further information and legal guidance related to counterfeiting in Ohio:

Ohio Revised Code § 2913.30 – Counterfeiting: A direct link to the statute defining counterfeiting, outlining prohibited acts, penalties, and applicable definitions.

U.S. Secret Service – Counterfeit Currency Information: The U.S. Secret Service is the primary federal agency for investigating counterfeit U.S. currency. This resource explains how counterfeit money is detected, common security features, and reporting procedures.

Hire an Attorney for Counterfeiting Charges in Hamilton County, OH

If you have been charged with counterfeiting, law enforcement already believes you intentionally attempted to defraud the public, a business, or the government. Successfully defending a counterfeiting case requires extensive analysis of documents, digital records, and forensic evidence, along with strategic challenges to the state’s claims about intent and identity.

Attorney Mark Wieczorek represents clients throughout Cincinnati, Ohio and the surrounding area.

Call (513) 317-5987 for a free consultation or submit our online contact form.